Get in Touch

-

To More Inquiry

06 328 9030

-

To More Inquiry

support@yetitech.nz

-

Whanganui, New Zealand

Budget Buddie

Budget Buddie

Project Goals

Tools Used

Their wants

Their needs

Identifying the problem

-

Complexity of financial tasks requiring simplification for everyday users.

-

Need for secure integration with multiple banking institutions while maintaining compliance.

-

Requirement for real-time financial tracking and predictive insights.

-

Demand for robust backend infrastructure capable of high transaction volumes.

-

Critical need for automated, efficient deployment processes and real-time error monitoring.

Scope of works

Application Development

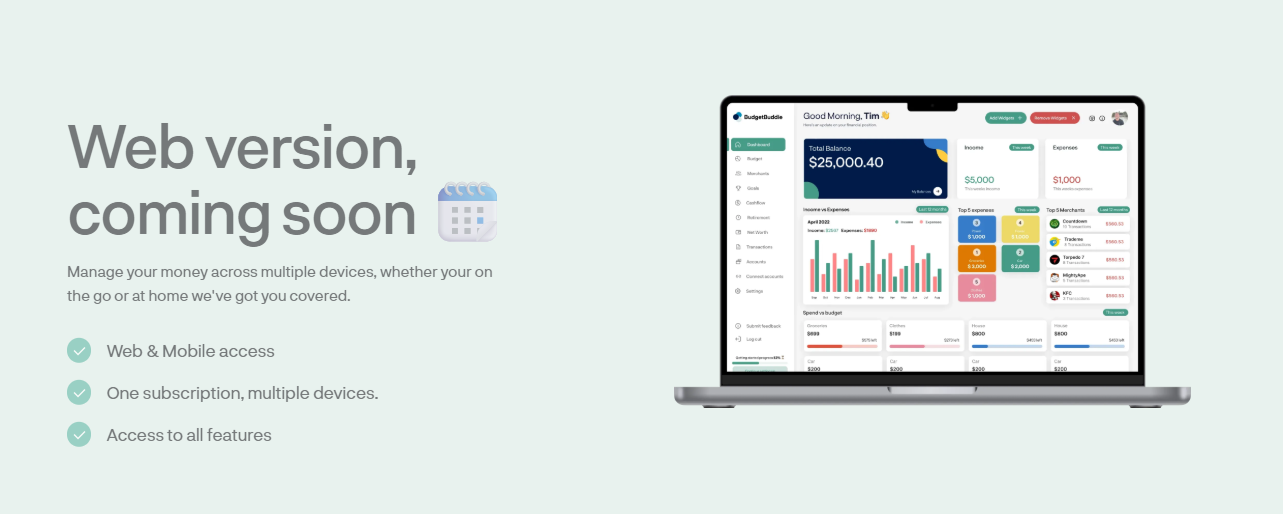

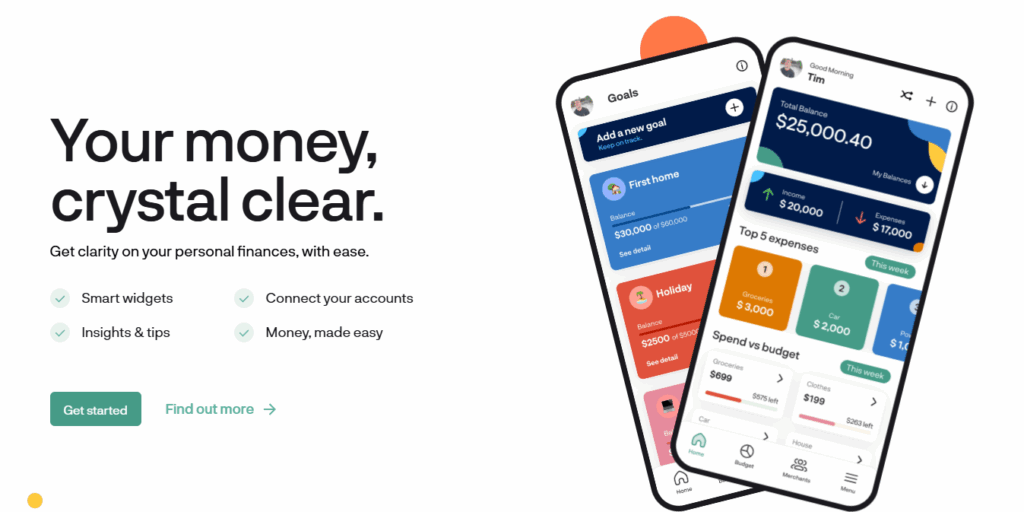

Build a responsive, cross-platform financial management application for iOS, Android, and desktop.

Security and Authentication

-

Implement AWS Cognito for secure login with multi-factor authentication (MFA).

-

Ensure end-to-end SSL encryption and password hashing.

Financial Management Tools

-

Develop real-time financial dashboards with budget tracking and income/expense visualization.

-

Integrate bank accounts and merchant tracking systems.

AI-Powered Features

Provide predictive financial insights and AI-driven retirement planning tools.

Notification System

Set up Amazon Pinpoint for omnichannel notifications, including push and email alerts.

Backend Architecture

-

Build serverless backend with AWS Lambda, DynamoDB, and API Gateway.

-

Use Sentry.io and Amazon CloudWatch for real-time error monitoring and performance tracking.

Deployment and Testing

Establish CI/CD pipelines using Bitbucket Pipelines for automated deployment and testing.

The Plan

Deploy AWS Cognito, Lambda, and DynamoDB as foundational services.

-

Build the financial dashboard, budget tracker, merchant tracking, and AI-driven insights modules.

-

Integrate seamless bank connections and automated alerts.

Ensure an intuitive, user-friendly design across mobile and desktop platforms.

Execute structured CI/CD deployment with thorough beta testing for reliability and performance.

The Strategy

Build on AWS cloud services to ensure security, scalability, and performance optimization.

Enable users to take control of their finances with predictive analytics and real-time tracking.

Design for high adoption and retention with intuitive, seamless user journeys on all devices.

Streamline deployments, notifications, and error handling through full-stack automation tools.

The Results

-

User retention improved by 65% thanks to AI-driven dashboards.

-

Untracked expenses reduced by 50% through real-time financial tracking.

-

AWS Lambda services reduced data processing times by 75%.

-

Zero security breaches post-implementation of AWS Cognito MFA.

-

Operational costs decreased by 40% due to serverless architecture.

Conclusion

The collaboration between Budget Buddie and YetiTech delivered a cutting-edge personal finance management platform that seamlessly integrates real-time banking, AI-powered insights, and predictive financial planning. Built on AWS serverless infrastructure, the solution ensures top-notch security, scalability, and user satisfaction. Budget Buddie now stands as a leader in personal finance tools, offering users a structured, reliable, and intelligent approach to managing their financial future with confidence. The successful deployment, automation, and client feedback underscore the project’s tremendous impact, setting the stage for future innovations in financial technology.